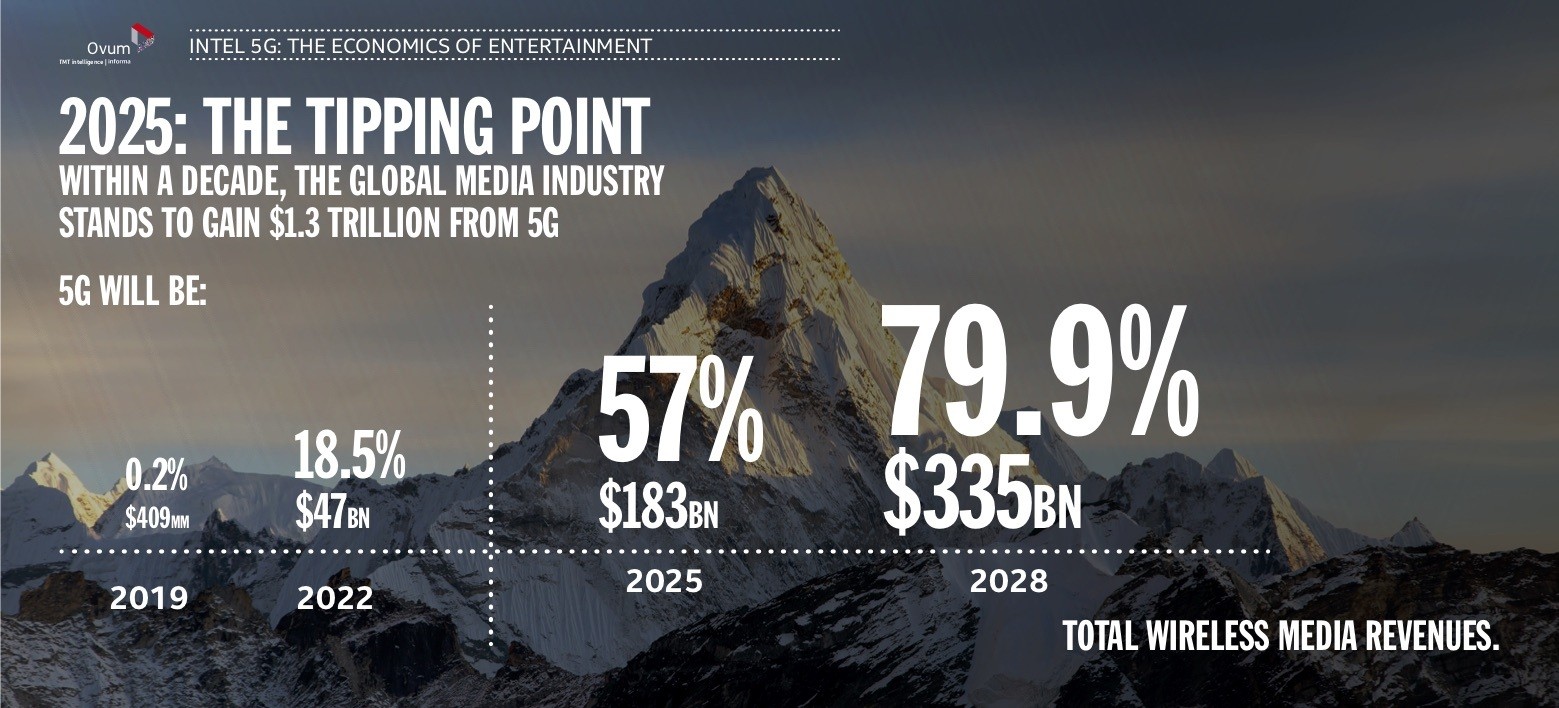

5G along with mobile edge computing will be instrumental in delivering immersive live content experiences and unravel new & exciting opportunities for a gamut of media services that can be delivered over mobile networks. Powered by 5G newer applications such as 4K video, AR/VR based virtual user experiences, 360 live streaming, collaborative viewing and working, location-based experiences, multiplayer video game streaming, high definition live broadcasting of events, and so on will drive the OTT growth. In fact, the same Intel report also extrapolates that 2025 will be a watershed year for 5G in media & entertainment as it will contribute to 57% of global wireless revenue.

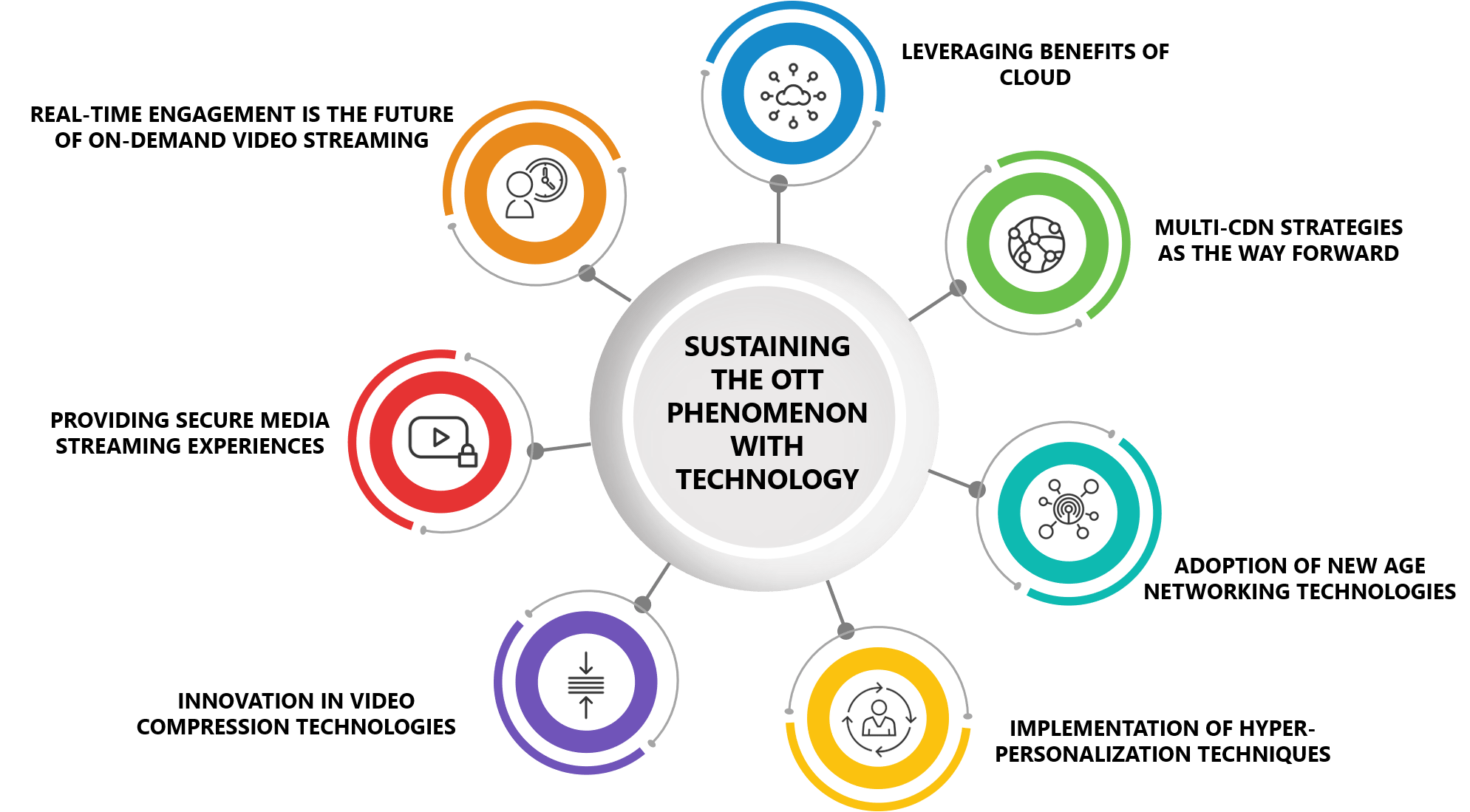

4.Implementation of hyper-personalization techniques by OTT service providers: As is with any industry, providing a world-class customer experience is a requirement that OTT players cannot ignore. Both existing and new players in the OTT space are investing in new-age technologies such as machine learning, AI, deep video analytics, etc. to understand their customers and their individual prefer preferences better which will help remain competitive in the market. Technologies such as artificial intelligence help in enhancing customer experience by analyzing their video preferences and suggesting videos via recommendation engines. A strong recommendation engine increases the stickiness of the platform hence reducing the customer churn. Producing fresh content is increasingly becoming difficult in the ongoing COVID scenario. Therefore, having recommendation engines will help showcase the less explored parts of the vast content library even after the pandemic situation has eased. Gamification of content also helps in tackling exigencies that happen when content production is hampered. For instance, ZEE5 as part of their Ad Suite, introduced PLAY5, an interactive tool that allows brands to engage with consumers via customized gamification, branded polls, quizzes, etc. Tuborg the beverage brand chose this tool to create a gamified karaoke platform and witnessed 5X more page views and 80 percent more consumer engagement. Having these intuitive features would further help in increasing the subscriber base, platform stickiness, and providing an enhanced quality of experience. It will also give OTT platforms a new way to monetize their platform.

5.Innovation in video compression technologies: To gain efficiency and tackle bandwidth consumption, content providers have been innovating on video compression technologies long before the onset of COVID, more than 20 years ago to be precise. We have witnessed major codec standards created about every 10 years, with MPEG-2 released around 1995, AVC in 2005, and HEVC in 2015. Key improvements such as dual-pass encoding, statistical multiplexing, and software migration have been made to compression technology in order to boost video streaming performance. In the last couple of years, Artificial Intelligence (AI) — is driving the next frontier of video compression enhancements with the promise of faster advancements. AI is being used to achieve better video quality (VQ) at a given bit rate or even better, achieve a lower bit rate without compromising the video quality. Advances are also being made in other directions, like higher density to where the same VQ/bitrate efficiency will use less computing resources, and in providing a better quality of experiences (QoE). Such innovations have assumed significance in the current pandemic situation where streaming media consumption has reached stratospheric levels. As more and more people shift from linear broadcast/Pay TV to OTT, streaming companies must invest in OPEX optimizations to ensure a seamless, buffer-free video viewing experience for their subscribers.

6.Providing secure media streaming experiences: Along with a great viewing experience, it is important to keep the content secure & tamper-proof. Hackers & pirates are always on the prowl to compromise the OTT platform, steal content, and user information. The revenues generated via OTT services are severely compromised when premium content gets leaked to piracy platforms. The exposure of premium content also jeopardizes compliance with content rights owners. Content owners trust OTT stream providers to ensure the security of their copyrighted content. The exposure of such premium content jeopardizes the compliance with content rights owners thereby leading to legal actions against the attacked OTT provider. The illegal sale of video content in 2019 cost the industry $9.1bn. Analysts have predicted that it would further hit $12.5bn by 2024. Enabling key security features such as server-side security & firewall, authorization tokens, watermarking techniques, being SSL certified, having studio-approved DRM integration can help mitigate the threat from piracy and illegal streaming.

7.Real-time engagement is the future of on-demand video streaming: As they battle for consumers’ attention, media companies and brands must find a way to focus on direct to consumer (D2C) engagement. This is perhaps one of the best ways for media companies to sustain solid relationships with consumers, prevent competitors from poaching them, and reinvigorate the disengaged customers by providing tailored offerings. Seamless interaction with customers via orchestration between apps, web, TV bots, and traditional contact centers, using OTT technology such as in-app messaging and bots to personalize user experiences are ways in which D2C engagement is made possible.

According to Iván Markman, the chief business officer at Verizon Media,

“The lack of live sports is pushing up consumption in other areas on Verizon Media properties, with 54% month-over-month growth in news, 60% increase in gaming and 134% increase in entertainment content”.

It is possible that once the pandemic situation eases, the breakneck speed in which the Media and Entertainment sector is growing may slow down a bit. Possibly, subscription fatigue will pave the way for innovation in OTT monetization with providers looking at the pay-per-view and advertising monetization as viable alternatives to subscription monetization. Bundling of different subscription packages to create channels is a trend that is upcoming now with Disney+ bundling its videos with ESPN, National Geographic etc. Eventually having led an OTT way of life once, consumers will continue to consume content based on their choice of content type, genre, and other options. Viewers can enjoy a seamless viewing experience owing to the flexibility and ease-of-use provided by the OTT video platforms.

Product Engineering Services Customized software development services for diverse domains

Quality Assurance End-to-end quality assurance and testing services

Managed Services Achieve scalability, operational efficiency and business continuity

Technology Consulting & Architecture Leverage the extensive knowledge of our Domain Experts