The Conventional RAN Technology:

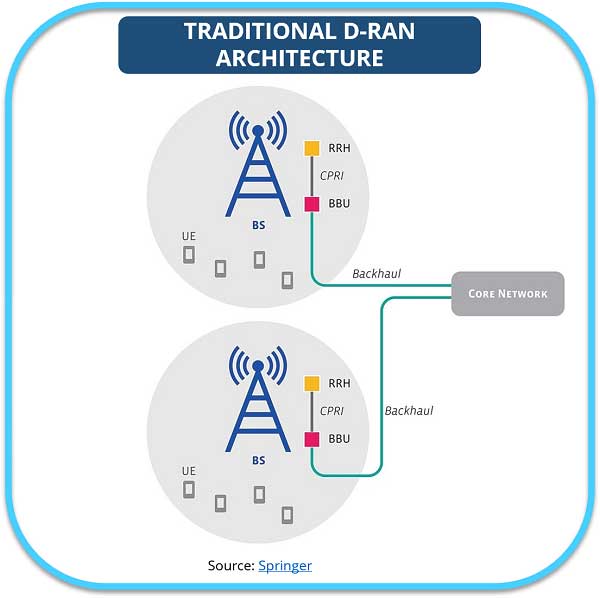

The traditional RAN infrastructure involves a Radio Unit (RU) and a Baseband Unit (BBU) along with the mobile devices/user equipment (UE). The RU transmits, receives, and converts the signals for the RAN base station. The RU communicates with the Baseband Unit (BBU) after receiving signal information from the antennas using the Common Public Radio Interface (CPRI). The BBU takes this signal information and processes to forward it to the core network. Finally, data returns to the user via the reverse process.

Thus, operators need to densify the network by adding more infrastructure to improve a cell’s operational capacity within conventional D-RAN architectures. However, this results in increased CAPEX as additional Base Stations need to be deployed, and each BS has an associated Radio Resource Unit (RRH) and Baseband Unit (BBU). Furthermore, the processing resources of a BBU cannot be shared among other RRHs.

Open RAN:

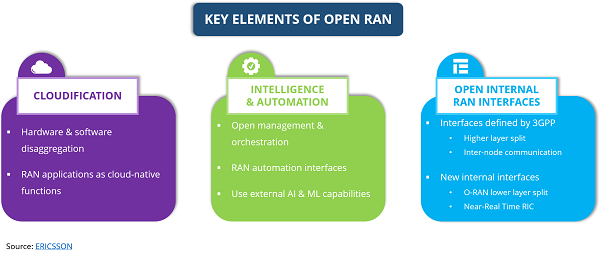

The current RAN technology is provided as a hardware and software integrated platform. Open RAN standards enable creating a multi-vendor RAN solution that utilizes open interfaces between hardware and software & hosting software that controls and updates networks in the cloud. The architecture promises a host of benefits for network operators and infrastructure providers, including supply chain diversity, solution elasticity, new capabilities leading to increased competition within the market, and facilitation of innovative use cases.

Open RAN Architecture Components:

Open RAN looks to enable operators to mix and match components within the RAN and facilitate interoperability between RAN equipment from different vendors. In an Open RAN environment, the RAN is separated into three main building blocks:

- The Radio Unit (RU): Component through which radio frequency signals are transmitted, received, amplified, and digitized. It is located/integrated into the antenna

- The Distributed Unit (DU): Sits close to the RU and runs the RAN Intelligent Controller (RIC), MAC, and parts of the PHY layer. This logical node includes a subset of the eNB/gNB functions, depending on the functional split option, and the CU controls its operation.

- The Centralised Unit (CU): It is a logical node that includes the gNB functions like transfer of user data, mobility control, RAN sharing (MORAN), positioning, session management, etc. The CU controls the operation of several DUs over the mid-haul interface.

The fundamental tenet of Open RAN is enabling operators to be able to cherry-pick best-of-breed vendors for different components like the radio, centralized unit (CU), distributed unit (DU), etc.

Open RAN Adoption:

A multitude of converging factors are encouraging Open RAN adoption:

- Reduction in upfront capital deployment costs

- Lower OPEX through automation

- Greater innovation

- Increased vendor diversity

Pioneered by the likes of Rakuten & Dish, who are showcasing greenfield deployments in Open RAN, incumbent vendors are also looking to embrace Open RAN for their networks in 2021-22. This list includes but is not limited to companies such as AT&T, Verizon, BT, Orange, Reliance Jio, MTN, NTT DoCoMo, and others.

Open RAN Standards:

The two most pertinent organizations working on Open RAN standards are the O-RAN Alliance & the TIP (Telecom Infra Project). The O-RAN Alliance has the mandate to define specifications to make different blocks within the architecture work seamlessly. TIP is more deployment & execution-oriented. These organizations are also continually sponsoring plugfests to support verification, testing, and integration of disaggregated RAN components. Innovation-driven by AI & ML is expected to help operators with bandwidth-heavy applications, and the RAN intelligent controllers (RICs) will play a focal role in this. Solutions like Radio Resource Management (RRM) & Self Organizing Networks (SON) can be implemented using AI/ML technologies.

Needless to say, to realize the promise of Open RAN, operators will have to count on system integrators to make disparate components come together cohesively and to address interoperability.

With cloudification & automation driving innovation in Open RAN, operators would need to diversify in-house talent and become more adept in software engineering, cloud-native architectures, and not just systems engineering.

O-RAN Challenges

Some of the key challenges which need to be addressed while considering O-RAN are interoperability, ownership, accountability.

With Open RANs, operators and integrators need to initially confirm that the technology works together before it goes into a live network.

One of the other challenges post-deployment is the ownership of an issue when it occurs and who solves it. In a traditional single-vendor network, when problems arise, operators can work with the single concerned vendor to resolve them. But with an Open RAN network, they would have to work alongside multiple vendors when a problem arises.

Also, ensuring interoperability, testing, and integration for the whole O-RAN ecosystem can be an arduous task.

From the security perspective, ORAN can potentially face similar security-related issues as most other virtual architectures. The disaggregation of various functions could increase the RAN threat surface. Additionally, the increase in IoT devices also increases the probability of potential attacks due to compromised devices.

Commercial O-RAN Solutions:

O-RAN ALLIANCE has specified a Minimum Viable Plan (MVP) Towards Commercial O-RAN Solutions. It will help O-RAN ecosystem players prioritize delivering a minimum viable set of end-to-end O-RAN solutions applicable in any commercial network.

The first release of the MVP includes already published specifications and additional work items for:

- Open fronthaul between O-RU and O-DU, enabling multi-vendor interoperability.

- Open transport will help define xhaul transport and proposes the best practices of deploying WDM and IP technologies in xhaul.

- Open stack provides a software reference design for O-CU/O-DU architecture

- Open cloud presents an O-Cloud reference design for real-life deployment recommendations.

- Open hardware offers hardware reference designs for different cell configurations and open fronthaul gateway to accelerate the use of white-box

- Open Testing and Integration Centers (OTICs) brings and sets testing and integration criteria to ensure consistency across O-RAN products and solutions.

Support for O-RAN by System-on-Chip (SoC) Vendors

O-RAN, SOC providers, Operators, OEMs, and solution providers are all essential partners in creating the Open Wireless Network as a Platform. The open and flexible 5G standards are driving the new development of highly customized hardware.

- Mavenir and Xilinx announced their partnership to bring 4G/5G O-RAN massive MIMO (mMIMO) solutions to speed up Open RAN deployments. Xilinx is a member of the O-RAN Alliance and is a contributor to the 3GPP specifications for 5G mobile networks, and offers silicon that supports multiple standards, bands, carriers, and sub-networks for Open RAN

- ArrayComm, a provider of a physical layer (PHY) software and hardware components for LTE and 5G base stations, selected Keysight’s integrated test portfolio to validate O-RAN radio and distributed units

- Airtel announced that they would utilize the Qualcomm 5G RAN platforms to roll out virtualized and Open RAN-based 5G networks.

Conclusion:

The market-based competition will ensure the merits of technical performance and competitiveness of solutions from different vendors in the Open RAN market. The freedom of the market would prevail, and 3GPP and O-RAN will co-exist and share several vital technological features – whether complement and competing with each other. The operators will have the freedom to choose from either technology.

Product Engineering Services Customized software development services for diverse domains

Product Engineering Services Customized software development services for diverse domains

Sustenance Engineering Going beyond maintenance to prolong life of mature products

Sustenance Engineering Going beyond maintenance to prolong life of mature products

Managed Services Achieve scalability, operational efficiency and business continuity

Managed Services Achieve scalability, operational efficiency and business continuity

Technology Consulting & Architecture Leverage the extensive knowledge of our Domain Experts

Technology Consulting & Architecture Leverage the extensive knowledge of our Domain Experts